Article content

(Bloomberg) — Private markets raised almost $230 billion for energy-transition funds over the past decade, creating a growing source of financing for clean energy and other renewable projects, according to BloombergNEF.

THIS CONTENT IS RESERVED FOR SUBSCRIBERS ONLY

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman, and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

SUBSCRIBE TO UNLOCK MORE ARTICLES

Subscribe now to read the latest news in your city and across Canada.

- Exclusive articles from Barbara Shecter, Joe O’Connor, Gabriel Friedman and others.

- Daily content from Financial Times, the world’s leading global business publication.

- Unlimited online access to read articles from Financial Post, National Post and 15 news sites across Canada with one account.

- National Post ePaper, an electronic replica of the print edition to view on any device, share and comment on.

- Daily puzzles, including the New York Times Crossword.

REGISTER / SIGN IN TO UNLOCK MORE ARTICLES

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account.

- Share your thoughts and join the conversation in the comments.

- Enjoy additional articles per month.

- Get email updates from your favourite authors.

THIS ARTICLE IS FREE TO READ REGISTER TO UNLOCK.

Create an account or sign in to continue with your reading experience.

- Access articles from across Canada with one account

- Share your thoughts and join the conversation in the comments

- Enjoy additional articles per month

- Get email updates from your favourite authors

Sign In or Create an Account

or

Article content

Much of that capital remains undeployed. About $92 billion is still sitting on the sidelines, said Ryan Loughead, a senior associate at BNEF in London. “It’s a pocket of money that’s increasing and it’s not inconsequential,” he said.

Article content

Article content

Article content

Brookfield Asset Management, Blackstone Inc., BlackRock Inc. and Copenhagen Infrastructure Partners are among the asset managers betting that rising energy demand and the improving economics of renewables will continue to drive investment. The funds are emerging as “a significant source of capital” for the energy transition, BNEF wrote in a report published Thursday.

Article content

By signing up you consent to receive the above newsletter from Postmedia Network Inc.

Article content

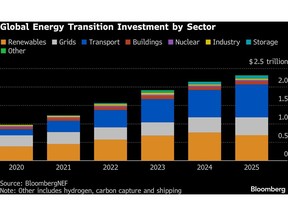

Even so, the world remains far short of what’s needed to avoid the worst effects of climate change. BNEF estimates annual spending of $5.2 trillion is required through the end of the decade for the global economy to stay on track for a net zero scenario. Last year, a record $2.3 trillion was invested in electrified transport, renewable energy, power grids and other green businesses, leaving the world well behind pace.

Article content

Based on available data, BNEF estimates that the median internal rate of return for dedicated transition funds ranged from an annualized 7% to more than 20% between 2015 and 2022, though the payback period varies significantly.

Article content

Private markets — investments in assets not traded on public exchanges — have expanded rapidly. Globally, assets under management in private capital climbed almost 20-fold to about $22 trillion between 2000 and 2024, according to estimates from McKinsey & Co.

Article content

In all, private markets have raised $2.7 trillion for funds investing in all sorts of energy, including fossil fuels, over the past decade, BNEF reported.

Article content

Brookfield Asset Management has done a series of big green deals in recent years, including a £1.75 billion ($2.4 billion) stake purchase in UK offshore wind farms from Orsted A/S. The asset manager also partnered with Microsoft Corp. in 2024 in what was then the largest announced corporate clean-energy purchase agreement.

Article content

(Adds estimated fund returns in the fifth paragraph.)

Article content